Why Understanding HVAC Financing Options Matters for Your Home

HVAC financing options help you manage the cost of a new heating and cooling system by spreading payments over time. Since few homeowners have thousands of dollars in cash for this major home improvement, financing makes it affordable. Delaying a necessary replacement can lead to higher energy bills and system failure, but you have multiple paths to get a new system now.

Your financing choice matters. The right agreement leads to manageable payments and ownership, while the wrong one can mean long-term debt and hidden fees. This guide will help you understand the true cost of a new system, compare financing methods, and find incentives to make a smart decision for your budget.

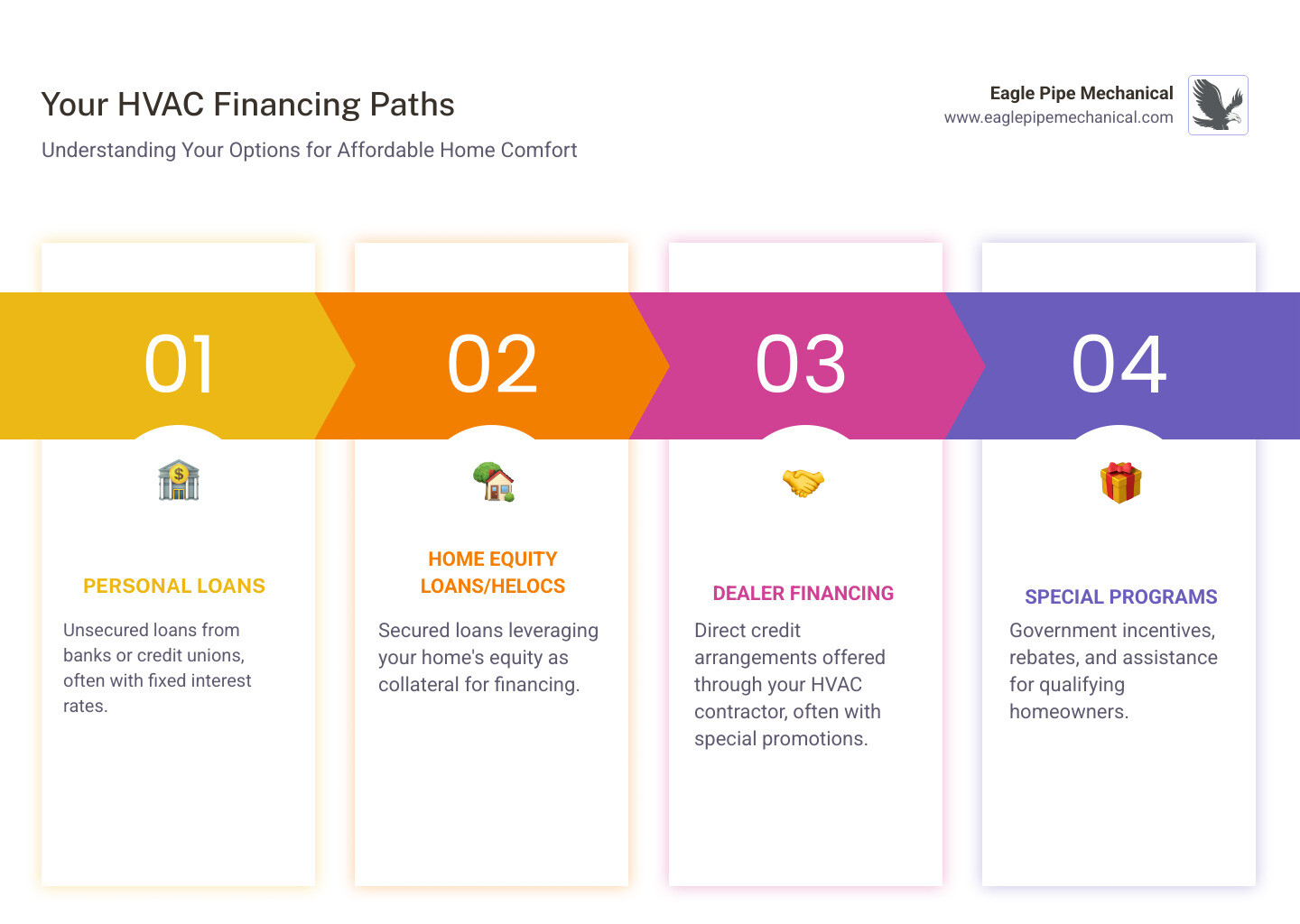

Here are the main ways to finance your HVAC system:

- Personal Loans: Unsecured loans from banks or credit unions with fixed rates.

- Home Equity Loans/HELOCs: Secured loans using your home’s equity as collateral.

- Dealer Financing: Credit arrangements directly through your HVAC contractor.

- Special Programs: Government incentives, rebates, and assistance for qualifying homeowners.

Whether you’re in Bremerton or Port Townsend, understanding these options lets you move forward with confidence.

Understanding the Total Cost of a New HVAC System

When you’re exploring HVAC financing options, it’s crucial to understand the complete cost, which goes beyond the price tag of the unit itself. A comprehensive quote should include several key components:

- Equipment Costs: The price of the furnace, air conditioner, or heat pump varies based on efficiency (SEER rating), brand, and features like smart thermostat integration or zoning.

- Labor Fees: Installation is not a DIY project. This covers the time for trained technicians to safely remove old equipment and install the new system, which typically takes 3-8 hours depending on the job.

- Infrastructure and Modifications: Older homes may need electrical upgrades or ductwork modifications to support modern, high-efficiency equipment and ensure proper airflow.

- Permits and Disposal: Your contractor will handle permit fees to meet local building codes and ensure the proper, environmentally safe disposal of your old unit and its refrigerants.

Before signing, get a detailed HVAC installation contract. It should specify the equipment model, a cost breakdown, warranty details, project timeline, and proof of the contractor’s license and insurance. This documentation protects you from surprises and helps you budget effectively.

Budgeting for Long-Term Efficiency and Repairs

Smart budgeting extends beyond the installation day. The true value of your HVAC system is realized over its 15-20 year lifespan.

Proactive maintenance is the best way to protect your investment. Regular seasonal tune-ups catch small issues before they become expensive emergencies. A simple but effective task is filter replacement every 1-3 months; a clean filter improves air quality and lowers energy bills by helping your system run more efficiently.

Smart thermostats learn your schedule and adjust temperatures automatically, often paying for themselves in energy savings within a year or two.

While we focus on proactive care to prevent breakdowns (and don’t offer 24/7 emergency services), it’s wise to understand that average repair costs can be significant for major issues. This is why regular maintenance is so important—it minimizes the chance of unexpected repair bills.

Finally, warranty coverage and service agreements provide peace of mind. A manufacturer’s warranty covers defective parts, while a service agreement typically includes annual tune-ups and discounts on future repairs, helping you budget for long-term care without worry.

Exploring Your Primary HVAC Financing Options

When your HVAC system fails, you need a new one fast. The good news is you have several solid HVAC financing options to get the comfort you need without draining your savings.

Your main choices are unsecured loans (which don’t require collateral but may have higher rates), secured loans (which use your home’s equity for lower rates but carry more risk), and dealer financing (which offers convenience and promotional deals).

Here’s how the most common HVAC financing options compare:

| Feature | Personal Loan | Home Equity Loan (HEL) | Home Equity Line of Credit (HELOC) | Dealer Financing (HVAC Company) |

|---|---|---|---|---|

| Loan Type | Unsecured (no collateral) | Secured (home as collateral) | Secured (home as collateral) | Often secured (via equipment lien) or unsecured |

| Interest Rate | Fixed (can be higher) | Fixed (generally lower) | Variable (can fluctuate) | Fixed or promotional 0% APR, then variable/high |

| Risk | Higher interest if credit is poor | Home at risk if default | Home at risk if default; rate changes | High interest after promo; potential hidden fees |

| Approval Speed | Moderate | Slow (requires appraisal) | Moderate to slow (requires appraisal) | Often quick (same day) |

| Best For | Good credit, prefer no collateral, smaller loans | Significant home equity, large projects, lower rates | Significant home equity, ongoing projects, flexibility | Quick need, promotional offers, convenience |

Traditional Bank and Credit Union Loans

Your local bank or credit union offers familiar loan products. A personal loan is a straightforward, unsecured option with a fixed rate and predictable payments. However, interest rates are higher, especially for those without excellent credit.

If you have equity in your home, you might consider a secured loan. A home equity loan provides a lump sum at a lower, fixed interest rate. A Home Equity Line of Credit (HELOC) works like a credit card, offering flexibility with a variable interest rate. Both use your home as collateral, meaning you risk foreclosure if you cannot make payments. The application process is also longer, often taking up to 60 days.

Financing Through Your HVAC Dealer or Manufacturer

At Eagle Pipe Mechanical, we partner with financial institutions to offer financing directly. This is often the fastest and most convenient option, with approval in minutes or by the next day.

Dealer financing frequently includes special promotional offers, like 0% APR for a set period. These can be fantastic, but you must read the fine print. After the promotional period, the interest rate can jump significantly, sometimes to 28.99% APR or higher on the remaining balance. This option is best if you have a solid plan to pay off the loan before the promotional rate expires. Always ask about fees and post-promo terms.

The Difference Between Financing and Renting an HVAC System

Financing leads to ownership. Every payment builds equity until the system is yours. Renting an HVAC system means you never own it. You make endless payments that can increase annually, often costing you far more in the long run than purchasing. Rental agreements may also include hefty buyout fees or place a lien on your property, complicating a future home sale. We believe in helping customers own their comfort, not rent it.

How Incentives and Special Programs Can Lower Your Costs

You may not have to pay the full sticker price for your new HVAC system. Various incentives from federal, state, and local sources can reduce your out-of-pocket costs by thousands of dollars, especially for energy-efficient models.

These programs reward homeowners for making environmentally conscious choices that reduce energy consumption. The Better Buildings Initiative’s financing navigator is a great resource to start exploring options.

Federal and State Energy Incentives

The federal government offers significant tax credits to promote energy efficiency. Thanks to the Inflation Reduction Act, homeowners can claim credits up to 30% of the system cost (with caps) for qualifying equipment installed through 2032.

- Heat pumps: Up to $2,000

- Natural gas, propane, or oil furnaces: Up to $600

- Central air conditioners: Up to $600

State and local utility providers often have their own rebates that can be combined with federal credits. Check the Database of State Incentives for Renewables & Efficiency and with your local utility provider in Kitsap or Jefferson County for available programs. We can help you identify which incentives apply to your equipment choices.

Assistance Programs for Qualifying Homeowners

Specialized programs exist for those who meet specific income or status criteria, recognizing that heating and cooling are necessities.

- Low-Income Households: The Federal Low Income Home Energy Assistance Program (LIHEAP) helps with energy bills, while the Weatherization Assistance Program (WAP) funds energy-saving home improvements, including HVAC replacement.

- Seniors: The U.S. Department of Agriculture offers income-based grants and low-interest loans for seniors 62 and older for heating and cooling equipment.

- Veterans: Military aid societies, in partnership with the American Red Cross, provide financial assistance for HVAC repairs and replacements. You can check your eligibility through their online application.

- Natural Disasters: If your system is damaged in a disaster and not covered by insurance, FEMA may offer assistance. Visit disasterassistance.gov to learn more.

These programs can provide life-changing financial relief, and we encourage any homeowner who might qualify to explore them.

How to Compare Offers and Choose the Best HVAC Financing Option

Now it’s time to choose the right financing for your situation. Approach this decision like buying a car: compare offers carefully to find the best deal.

When comparing loan proposals, look at these key factors:

- Annual Percentage Rate (APR): This is the true cost of borrowing, including interest and fees. A lower APR means a cheaper loan.

- Loan Term: A shorter term means higher monthly payments but less total interest. A longer term lowers monthly payments but costs more over time. Choose what fits your budget.

- Hidden Fees: Ask for a full breakdown of all costs, including origination fees, application fees, or prepayment penalties for paying the loan off early.

- Customer Service: Check online reviews and talk to representatives. You’re entering a multi-year relationship, so good service matters.

Always get at least three different financing quotes to compare side-by-side. This gives you negotiating power and ensures you get the best value.

The Role of Your Credit Score in HVAC Financing

Your credit score heavily influences the rates and terms you’ll be offered.

- Good to Excellent Credit (700+): You’re in a strong position to receive the best interest rates and terms from lenders.

- Fair Credit (600-699): You still have options, but interest rates will be higher. Dealer financing can sometimes be more flexible for this credit range.

- Lower Credit: Traditional loans may be difficult to obtain. Look into assistance programs (LIHEAP, WAP) or secured loans if you have home equity. Some dealer financing options may exist, but be cautious of the terms.

Check your credit score before applying to set realistic expectations.

The Value of Warranties and Service Agreements

Protect your investment with warranties and service agreements. A manufacturer warranty covers parts (often for 10 years), while a labor warranty from your contractor covers the installation work (typically 1-2 years). At Eagle Pipe Mechanical, we stand behind our quality installation.

Maintenance plans (or service agreements) are also valuable. For an annual fee, you get regular tune-ups that prevent expensive emergency repairs, improve efficiency, and extend your system’s lifespan. While we don’t offer 24/7 emergency services, we believe proactive maintenance is the best way to avoid those situations.

Why an Energy-Efficient System Is a Smart Investment

Spending more upfront for an energy-efficient system pays off in the long run. You’ll benefit from:

- Lower utility bills every month.

- Increased property value.

- Improved indoor air quality from better filtration.

- A reduced carbon footprint.

- Eligibility for federal tax credits and local rebates that lower the net cost.

When you factor in these benefits, an efficient system is a clear winner for your budget and comfort.

Frequently Asked Questions about HVAC Financing

Here are answers to some of the most common questions we hear from homeowners in Kitsap and Jefferson Counties.

What credit score do I need to finance an HVAC system?

It depends on the financing type. For the best rates on traditional loans from banks, you’ll generally need a good to excellent score (700+). Dealer financing is often more flexible and may accommodate fair credit scores (600-699), though at higher interest rates. Secured loans like home equity loans may have lower credit requirements than unsecured personal loans because your home acts as collateral.

Is it better to pay cash or finance a new HVAC system?

This depends on your financial situation.

- Paying Cash: The main benefit is avoiding interest, making it the cheapest option overall. However, it can deplete your emergency fund, leaving you financially vulnerable.

- Financing: This allows you to keep your savings for emergencies. It spreads the cost into manageable monthly payments. If you can get a 0% APR promotional offer and pay it off in time, you get an interest-free loan while preserving your cash.

If paying cash would strain your finances, financing is often the smarter move. If you have ample savings and prefer to be debt-free, cash is a great choice.

How do I apply for federal tax credits for my new HVAC system?

Claiming federal tax credits is a straightforward process:

- Confirm Eligibility: Ensure your new system meets the required energy-efficiency standards. Your contractor should provide a manufacturer’s certification statement.

- Keep Your Records: Save all receipts, invoices, and the certification statement.

- File with Your Taxes: Use IRS Form 5695, Residential Energy Credits, when you file your federal income taxes for the year the system was installed.

We strongly recommend consulting a qualified tax professional to ensure you claim all eligible credits correctly. These credits reduce your tax bill dollar-for-dollar, making a high-efficiency system much more affordable.

Conclusion

Navigating HVAC financing options is about making a smart investment in your home’s comfort and value. You have many choices, from traditional bank loans and dealer financing to valuable government incentives that can lower your cost.

The key is to compare offers, read the fine print, and choose a path that fits your budget. An energy-efficient system, combined with the right financing, is an investment that pays you back through lower utility bills and increased home value.

At Eagle Pipe Mechanical, we’re your neighbors in Kitsap and Jefferson Counties. We believe home comfort shouldn’t come with financial stress. We’re here to walk you through every option and help you find a solution that works for your family.

Ready to take the next step toward affordable, reliable home comfort? Let’s talk about what’s right for your home.